The Follow Up — Spring 2021

Long time ─ No communication. Why? A combination of covidpression, other endeavors, lassitude, and spending more time on the 40+ accounts I oversee. Voila’ ─ house arrest frees up a lot of time!

This offering will be in three sections:

A. Results of following the path I suggested on 11/20/18 (to 11/20/20)

B. A review of Grandpa’s twenty investment rules. There’s one significant addition (Rule 5) and reaffirmation of the many tenets that remain valid and important. (Hint ─ don’t expect any excitement.)

C. My investing experience during that 2 year period: Positives and negatives, with nothing left out.

This entire exercise has two objectives: To establish a set of rules for stock investing, and find the ETFs that will be the most rewarding.

And, remember, buying and holding an index ETF in any of the four stock classes (small cap value and growth, and large cap value and growth) will eventually be fruitful. Finding the optimum vehicle is our mission.

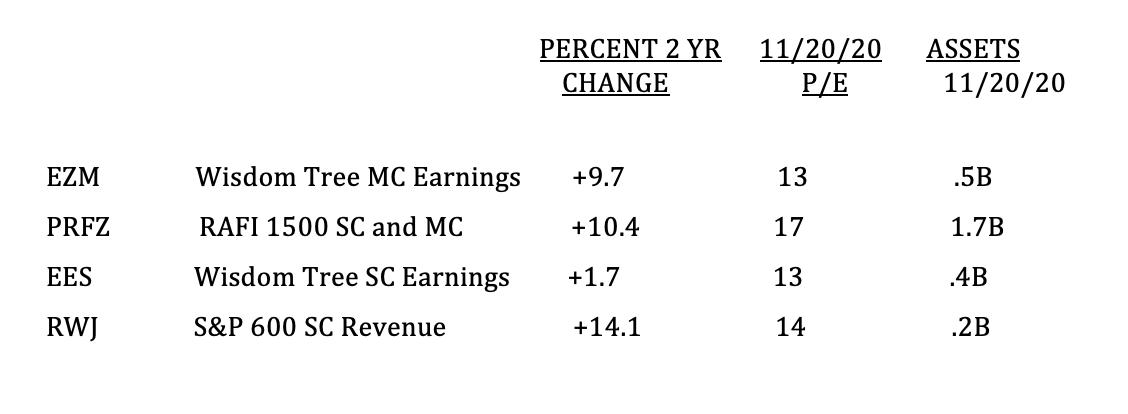

A. EZM, PRFZ, EES, RWJ and Other Small-Cap Value ETFs: 11/20/18-11/20/20

1. Well, I think I can claim an Olympic Gold for bad timing. Although the ETF’s I recommended were up modestly from 11/20/18 to 11/20/20, they were significantly outpaced by the S&P 500 and left in the dust by the Nasdaq 100. I think the post 11/20/18 vacation our 4 smart-beta small cap value ETF’s took was excessive, and they did it without my (or your) permission. (Of course RJF, the ETF I later suggested selling, was the best performer).

Making matters worse were their devastating losses during the evanescent (4 week) bear market of March, 2020. Holding on during that period took nerves of steel and a stomach of Kevlar- reinforced leather.

The enclosed table shows the performance (from 11/20/18 to 11/20/20) 1. of the Major Market Index ETFs and 3 categories of Value ETFs: 2. my recommended Smart Beta Small Cap Value (SPSCV) ETFs, 3. other small and mid cap Value ETFs, and 4. small and mid-cap blend (Value and Growth) ETFs.

TWO YEAR PERFORMANCE of RELEVANT ETFS ─ 11/20/18 to 11/20/20

Major Index ETFs

RECOMMENDED SMART BETA SMALL-CAP and MID-CAP VALUE ETFs

Other Small and Mid Cap Value ETFs

Small & Mid Cap Blend (Value Plus Growth) ETFs

In the two year period, returns on SPY, and particularly QQQs, were well above the norm, reflecting the prevailing stock-buying fashion of the period. And the reverse is true for the small-caps in groups 2,3, and 4 ─ they were out of fashion.

The ETFs in groups 2. and 3. represent the class of stocks I suggested as life-time investments ─ they are Small-Cap Value. As seen in the Table, the four Smart Beta Small Cap Value ETF in group 2. appear to have outperformed their peers in group 3. The higher returns of group 4. reflect their inclusion of “fashionable” growth stocks.

Returns in all groups were actually better than shown in this data: Dividends (hopefully reinvested) were not included.

At present, small cap stocks are in vogue. Returns of our 4 ETFs from 11/20/18 to 3/12/21 were: EZM +40%, PRFZ +49%, RWJ +91%, and EES +42%.

B. Revisiting Grandpa’s Rules

[Note: This material is best read from a printout with the “Grandpa’s Rules” section of this website.]

Well, this revisit could be sermonesque (you won’t find that one in the dictionary) or “short and sweet.” I’ve chosen the latter, and I can hear your sigh. The reason: With the exception of one significant addition, I’m more convinced than ever that these rules are valid ─and they’re THE WAY TO GO.

My heretical recommendations (no conventional diversification with bonds or deals, being fully invested at all times, no rainy day fund, and buying and holding a few selected ETFs) make more sense than ever to me. How do I know some people are taking this stuff seriously? Well when I foolishly sold our stocks last fall, (as described in Section C.,) two of my grandchildren called with “Grandpa, why are you selling?” That makes the whole trip worth it: I think I’ve planted some good seeds.

Rule #5 — Significant Addition

Let me repeat one thing that will always be true: BUYING AND HOLDING A BROAD ETF OF ANY OF THE FOUR STOCK CLASSES WILL BE PROFITABLE OVER TIME.

My formula has been to buy and hold our 4 Smart Beta Small Cap Value (SBSCV) ETFs. We know Small Cap Value has excelled over 90 years. Our SBSCVs are in full bloom now ─ and still relatively inexpensive. Unless history makes an abrupt U-turn, holding EZM, PRFZ, SWJ, and EES will be rewarding.

That said, there’s another horse in the race ─ one that wasn’t born until 60 years after the race started. And that horse is a thoroughbred named QQQ. (QQQ is an ETF of the 100 largest Nasdaq companies.)

The Nasdaq has only been in existence since 1976, and QQQs were introduced in 1999. Since then, QQQs have outperformed SPYs and SCVs.

The fact is that we’re living in an unprecedented era ─ an era where the LARGEST COMPANIES ARE ALSO THE FASTEST GROWING.

The influence of these Goliaths is well demonstrated in the holdings of the two major index ETFs ─ QQQ and SPY. The six largest holdings in both index ETFs are the same ─ Apple, Microsoft, Amazon, Facebook, Tesla, and Google. But since QQQ has only 100 stocks and SPY has 500 stocks, the six largest holdings represent 44% of QQQs and only 24% of SPYs. The outperformance of these largest stocks has resulted in QQQs besting SPYs in recent years.

I suggest slowly developing a position in QQQs (especially when the index, as it inevitably will, stumbles).

[Note: There is a clone of QQQ ─ QQQM. The QQQMs have exactly the same portfolio, but the M’s sell at less than half the price of the Qs, and have a .15% management fee vs. .2% for their big brother.]

C. My Relevant Investing History

My ad in the Wall Street Journal ran on 11/20/18. At that time the assets I managed, and my personal assets, were fully invested in RWJ, EZM, EES, and PRFZ (all Smart Beta Small Cap Value ETFs). I PRACTICED WHAT I PREACHED.

In late February, 2020, I was fortunate to recognize that the selling at the start of the pandemic was a true BLACK SWAN EVENT. [Definition: A “Black Swan Event” is a momentous and totally unexpected calamitous stock market event. I would add that it must include an element of extreme unpredictability ─ i.e. the world financial crisis in 2008-9, and the pandemic of 2020.]

At that time the 40+ accounts I managed were valued in the mid eight figures ─ all totally invested in three relatively small ETFs (EZM, EES, and PRFZ). Orderly complete liquidation of these large positions was a real challenge, and took six days of non-stop selling.

For three weeks, from early to late March, I was totally in cash (and I expect Charles Schwab to remember me in his will).

Although I had no idea where the bottom would be, I started buying very early in the recovery. WHY? Mainly, to protect the profits of my early selling. Other factors were the prevailing near-universal negativity, and my strong feelings about being fully invested in ETFS at all times.

As for the SBSCV ETFs, it was unrealistic to consider rebuying these small ETFs with the assets I was managing. What I did buy were three very large and liquid ETFs (QQQ, SPY, and XBI). The largest accounts also had smaller positions in AMZN and GOOG.

Time for some bad news: An event that marks me as a better advisor than investor. In September, 2020, I decided prices on what we owned were too high, and sold everything (very easily this time). Hey, I hit a homerun in March, and I could do it again! I violated Rule 12: YOU CAN’T TIME THE MARKET. [ An aside: Who was the greatest market timer ever? Ans: NOBODY.] Several days later, I corrected my error and fully reinvested (donating several percent in the process). This time it was 100% QQQs in the great majority of accounts. In the eight largest accounts there were also small positions in Amazon. (I know I’m violating Rule 4 ─ don’t buy individual stocks. And I’ll fess up to that mistake 2 years from now.)

Future plans? QQQs have had a great run, but “Santa Claus doesn’t visit every day”. They also have a P/E of 35, about twice the P/Es of EES (14), PRFZ (19), EZM (16) and RWJ (14). At this point it’s reasonable to expect a period of stagnation, probably with a significant drop along the way. But I’m going to take my own advice and stay put. Two reasons: Qs represent the fastest growing companies, and “jumping around” eventually leads to a bad landing.

Takeaway: I would stay with the four Smart Beta Small Cap Value ETFs, while gradually establishing a position in QQQs. [We live in an internet technology world, and the most buoyant companies comprise the bulk of QQQs.]

To Your Wealth,

Marty Schulman