Follow Up — Winter 2024

January 3, 2024

Hello again. I recently turned 90, and putting stuff together is getting more difficult. I still have my marbles, but they’re rolling slower and not as far. On the positive side, though my work capacity has diminished considerably, I may still be capable of deriving insights that might augment investment performance.

Every stock market investor starts out convinced they can “beat the market”. Of course, they don’t. There’s an easy solution: JOIN the market. What I’m doing is promoting specific broad index ETFs that are, based on historical performance, most likely to outperform what is generally considered to be “the market” – the S&P 500.

Do you know anyone who buys and sells stocks frequently (i.e. “plays the market”) who, over a long period, has done better than the S&P 500? If so, you know a very rare bird! Possibly extinct?

“If you play, you pay.”

This follow- up will be presented in several segments. This segment is Comments and Two Observations. One observation has already occurred and the other is anticipated. There are also three “Tidbits” ─ two personal musings and one of substance.

Other important topics will be in future segments.

Also included is a bonus: Something I wrote 10 years ago. Although the numbers have changed, the concept is still valid. And there is one thing I’m absolutely certain of ─ there’s at least one person in the world who thinks this is good stuff.

A. COMMENTS

I’m sad to report a lack of intuitive magic in the bear market of 1/22 to 10/22. And, as usual, I broke my no sell rule in 2022 and made a small contribution. I tell my children and grandchildren (and you) never to sell – then I do it – then I regret it. I should read Tidbit #2 every nite.

Our Smart Beta Small Cap Value ETFs have been hibernating, and lag the recovery of major indexes. But, there are several reasons to anticipate strong performance from our Smart Beta Small Cap Value ETFs. Read on…

B. TWO OBSERVATIONS

SMART BETA SMALL CAP VALUE ETFs

(Note: This SBSCV material was written in late November 2023).

1. I’ve watched the talking heads on CNBC for many years ─ with some derision. “Joe, we think the Pan ─ Siberian Bear Hide ETF will go to 1,423 by June, but all bets are off if the polar ice pack melts.” Let’s face it ─ Warren has it right – “I don’t know what will happen in the market.”

That said, I’m doing something I swore I’d never do. There are a number of indications our four Smart Beta Small Cap Value ETFs will rise significantly in the foreseeable future. (If you’re going out on a limb, make it a long limb.)

A. Their P/Es are about ten ─ and were considerably higher in the past.

B. Yields, now at approximately 1.5%, are much higher than the .5% we’ve been accustomed to.

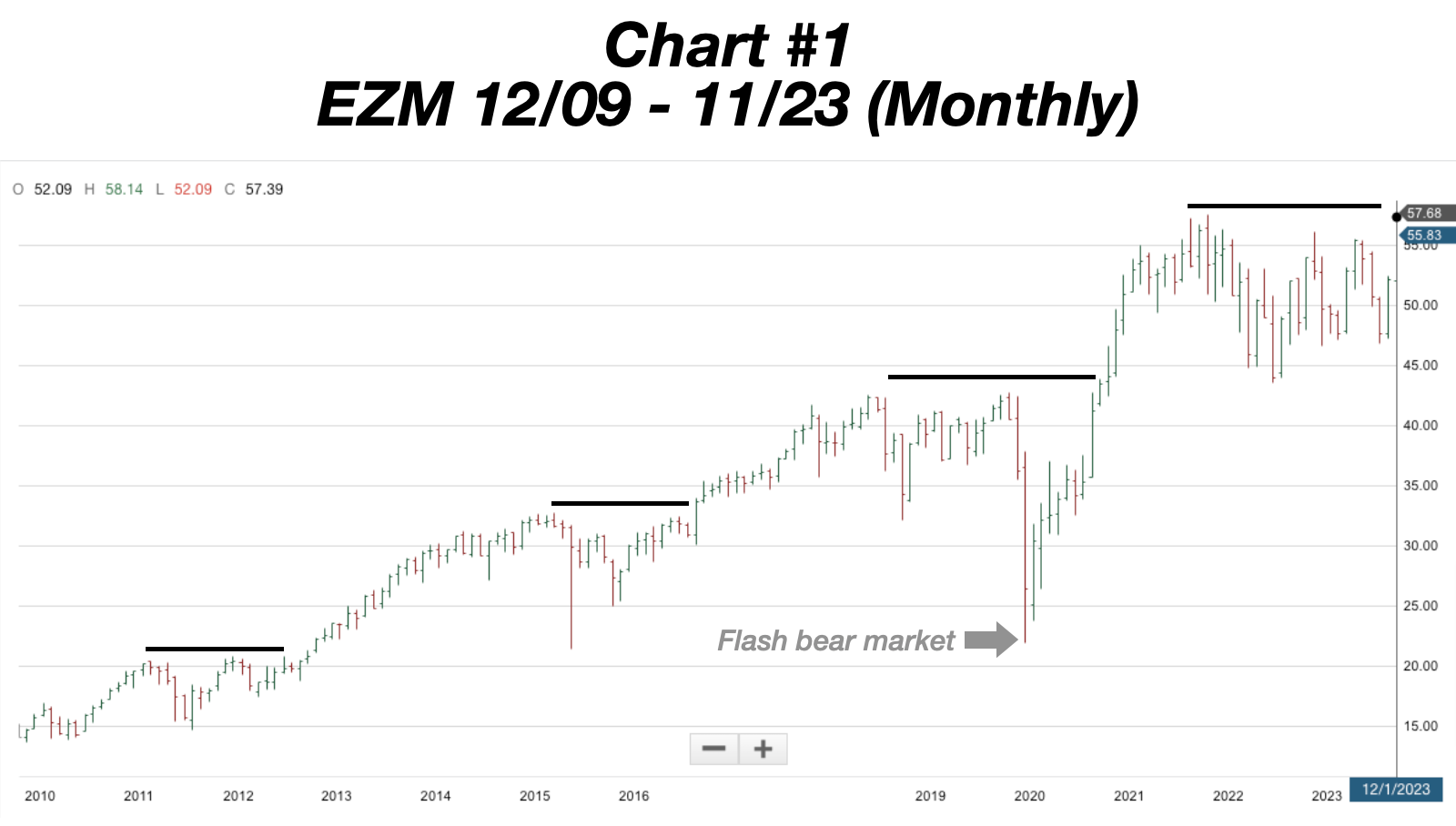

C. Their long-term charts (Chart 1. EZM as an example,) show periods of stagnation. Each of these plateaus were followed by significant rises. Table 1.

Let’s hope this pattern remains intact.

Chart #1: EZM 12/09 - 11/23 (Monthly)

Table 1: Smart Beta Small Cap Value SBSCV PERFORMANCE

SELLING CLIMAX

2. What is a selling climax? It’s easy to find definitions: Precipitous selling in an established downturn, on increased volume. Examples can be easy or hard to find: the definition is elastic and you determine the criteria. One good example is the selling that followed the 9/11/2001 terrorist attack, although that may not count, since it was event related. In the 5 consecutive down trading days from 9/10/2001(close 110.5) to 9/21/2001 (low 93.8) SPYs were down 14.8%. QQQ, the Nasdaq 100, lost an astonishing 20.1% at its low.

Chart #2: Selling Climax 2001 — SPY

It took me more than four months for me to appreciate and act upon the very significant market events of 6/7/22 to 6/14/22. The closing price of the S&P 500 ETF (SPY) on 6/7 was 416 and lowest on 6/14 was 374. That 11% drop occurred on five consecutive down trading days. Voila’, a (self-certified) SELLING CLIMAX.

Chart #3: Selling Climax 2022 — SPY

What I found of particular interest were the two large GAPS in SPY price during the 2022 selloff. There was a 1.4% gap between the lowest SPY price on 6/9 and the highest on 6/10. That was followed by an even larger gap (2.1%) between 6/10 and 6/11.

My reentering the market in October 2022, was based on what I viewed as the June Selling Climax.

I followed 2 important rules: I went All-In (none of the accounts I manage has more than $300 in cash,) and, as I mentioned, bought QQQs and SBSCVs. No bonds or individual stocks! And NO private placements ─ if they get down to you, it’s because many parties higher on the chain previously passed on them.

Although the market eventually declined further, I felt the precipitous drop in June indicated most of the blood had been shed. Thus far, that has been the case.

C. THREE TIDBITS

I. There is one indicator that has been a consistent market winner (don’t get too excited). Every morning I predict market action for the day. I don’t keep records, but I estimate I’m wrong 70% of the time. Fortunately, my distant vision seems more accurate.

II. The importance of rule #2, “The Doctrine of Relative Importance,” in “Grandpa’s Guide” cannot be overstated. When you start to accumulate significant assets do you buy a Porsche or invest in a home, broad ETFs, more education, etc. That one’s easy.

When faced with a more difficult decision, don’t rely on your own opinion: Ask yourself how you would advise someone else in the same situation. Distancing your personal emotions makes decision making much more rational. Another way to say it ─ Take yourself out of the equation. AXIOM: “IT’S EASIER TO LOOK OUT THE WINDOW THAN LOOK IN A MIRROR.”

“Cover the mirror and open the window. ”

[Personal Note: I put considerable effort into these every 2 ½ year notes, but it’s a labor of love. And I get a reward you can’t buy ─ I’m forced to take a very, very long look out the window!]

III. Now that I’ve gotten the trivia (#I) and the preaching (#II) out of the way, here’s a suggestion that could be of great value in your investing.

I believe every portfolio should have a significant position in QQQs. In the next segment of this follow-up I’ll present substantiating data. And, barring a major left turn in my good health, it will arrive in a much more reasonable time.

And last ─ I would love to hear from you. Comments (positive or negative), new ideas, upgrading “rules”, and personal experiences are welcome. But please, please ─ no pictures of you staring out a window.

Bonus (at least in my mind)…

If you’ve made it this far, you deserve something special (but this is the best I can do).

Marty Schulman

ms1633@yahoo.com